- #Can you use quicken on a mac how to

- #Can you use quicken on a mac download

- #Can you use quicken on a mac free

QuickBooks divides its tax features into two different tools: sales tax and deductions.

#Can you use quicken on a mac how to

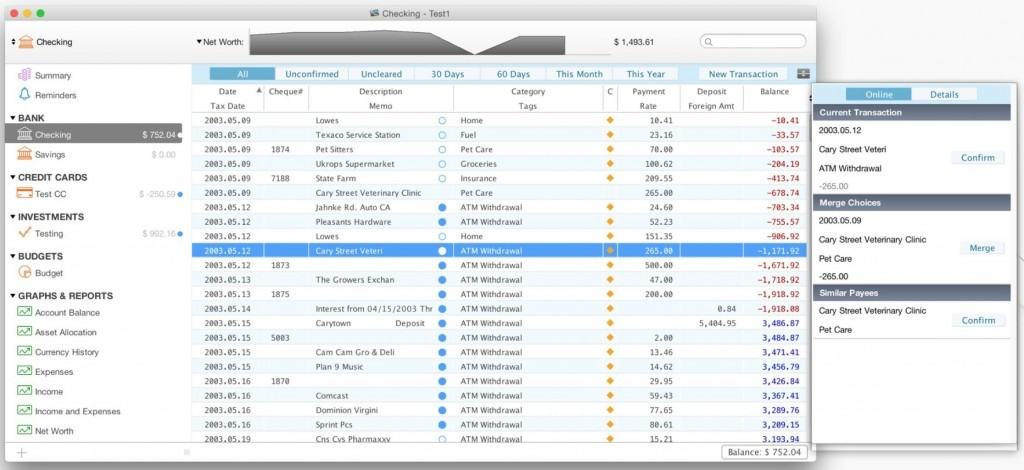

This article compares how QuickBooks and Quicken approach the major small business accounting software features you need and ends with some tips on how to choose between them. Because Quicken is primarily designed for personal use, its business capabilities are limited, but it could be just enough for those looking for a small business accounting software that helps them balance all their income. The official line on Quicken Home & Business is that it’s “suitable for all business sizes,” but the features work best for small personal businesses and secondary income from rental properties. Quicken is a widely-used personal accounting and budgeting software that offers a home and personal business accounting tool. Many accountants use it, too, and will recommend it to small businesses as a first accounting software. It’s what a lot of businesses start out with when they move from spreadsheets to an accounting software. Intuit QuickBooks is the gold standard for small business accounting software.

#Can you use quicken on a mac free

To get fast, free recommendations of the best accounting software for your business, click on the banner below to access our Product Selection Tool or contact us today to speak to one of our Technology Advisors. You’ve got options for small business accounting software, and QuickBooks vs. An accounting software will help you track your income and business expenses and will make tax time less painful. Whether you’ve owned your own business for a while or you’re just lining up your first client, you’ll need to think about managing your money. Read the TIAA-CREF Individual & Institutional Services, LLC, Statement of Financial Condition Opens pdf .Summary: This article compares how QuickBooks and Quicken approach the major small business accounting software features you need, and ends with some tips on how to choose between them. Its California Certificate of Authority number is 6992. TIAA-CREF Life Insurance Company is domiciled in New York, NY, with its principal place of business in New York, NY. Its California Certificate of Authority number is 3092. Teachers Insurance and Annuity Association of America is domiciled in New York, NY, with its principal place of business in New York, NY. Each is solely responsible for its own financial condition and contractual obligations. Annuity contracts and certificates are issued by Teachers Insurance and Annuity Association of America (TIAA) and College Retirement Equities Fund (CREF), New York, NY. SIPC only protects customers' securities and cash held in brokerage accounts. TIAA-CREF Individual & Institutional Services, LLC, Member FINRA Opens in a new window and SIPC Opens in a new window , distributes securities products. Please consult your tax or legal advisor to address your specific circumstances. The TIAA group of companies does not provide legal or tax advice. Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency, are not a condition to any banking service or activity, and may lose value.Ĭonsumer and commercial deposit and lending products and services are provided by TIAA Bank®, a division of TIAA, FSB. If you accept the entry and it's still not fixed, please give us a call at 86. QFX file again, or delete the unwanted transactions.Ĥ) TIAA Traditional placeholder messaging Opens pdf – TIAA Traditional requires you to accept a placeholder entry to adjust the daily balance when there is not an actual transaction to adjust the balance.

#Can you use quicken on a mac download

How to fix it: Check your other account balances for accuracy, then either delete accounts with incorrect balances and download the.

How to fix it: Delete the account and download the Quicken (.qfx) file again.ģ) A TIAA account is linked to a non-TIAA account. How to fix it: Edit cash balance to zero and/or change the account type to 401(k)/403(b).Ģ) The ticker symbol and/or price may be incorrect. (Note: Directly-held mutual funds accounts should be set up as brokerage accounts.) This likely means your retirement accounts or an IRA was incorrectly identified in Quicken as a brokerage account. There are 4 primary reasons this could happen:ġ) Your account has a cash balance (positive or negative).

0 kommentar(er)

0 kommentar(er)